For many people, the main point of investing is to generate higher returns than the overall market. But even the best stock picker can only win if: Several choice. Some shareholders may have doubts about investing in the company at this point. Vera Bradley Co., Ltd. (NASDAQ:VRA), since its stock price has fallen 45% over the past five years. Shareholders have fared even worse recently, with the stock price down 10% over the past 90 days. We note that the company reported its results fairly recently. And the market is hardly happy. You can see the latest numbers in our report.

It's worth assessing whether the company's economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let's just do that.

Check out our latest analysis for Vera Bradley.

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One way he looks at how market sentiment has changed over time is to look at the interaction between a company's share price and his earnings per share (EPS).

During five years of stock price growth, Vera Bradley went from a loss to a profit. Most people would think that's a good thing, so it's counterintuitive to see the stock price fall. Other indicators may better explain the stock price movement.

In contrast to the share price, earnings actually grew by 2.7% per year over five years. A closer look at earnings and earnings may or may not explain the reason for the share price slump. There might be a chance.

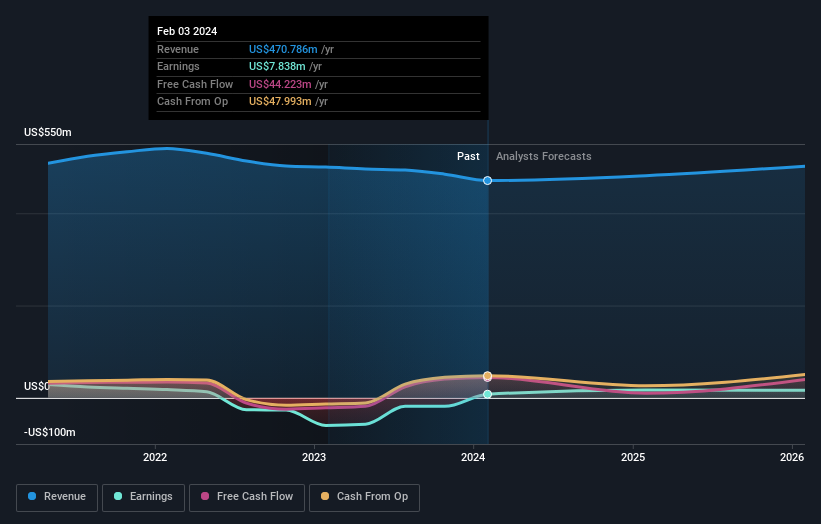

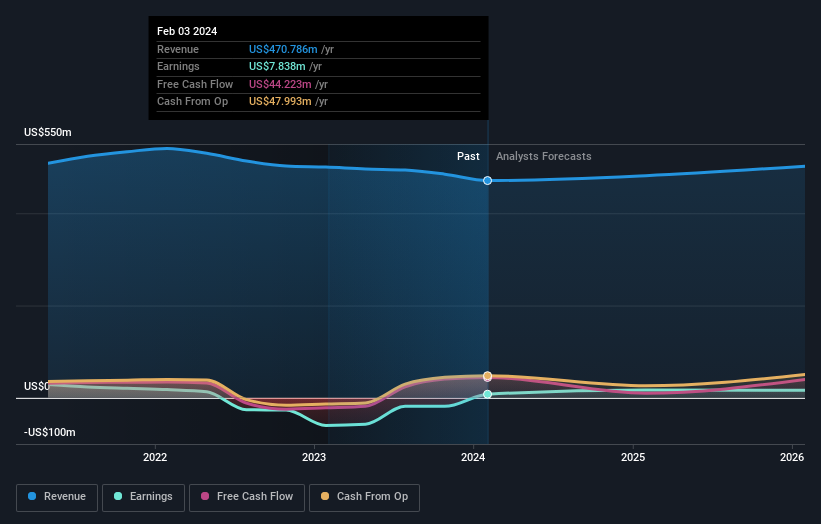

You can see below how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Vera Bradley has improved its earnings recently, but what does the future have in store? So, how much profit do analysts think Vera Bradley will earn in the future? It makes a lot of sense to check (free profit prediction).

different perspective

Vera Bradley shareholders received a total return of 5.3% for the year. However, its returns are below the market. On the bright side, this is still a profit, and certainly better than the roughly 8% annual loss it endured for over 50 years. Therefore, this could be a sign of an upturn in business fortunes. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, we discovered that 1 warning sign for Vera Bradley What you need to know before investing here.

of course Vera Bradley may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.