what do you think verizon communications (VZ 6.70%) It may depend on whether you see the proverbial glass of water as half empty or half full. For example, some may note that telecommunications stocks have significantly lagged stock prices. S&P500 Over the past 12 months. However, some have rightly pointed out that Verizon has dominated the market over the past three and six month periods.

The difference in opinion could surface in the company's fourth-quarter results, which will be released on Tuesday. Verizon released a lot of bad news, but here's why investors didn't care.

Bad news for Verizon on multiple fronts

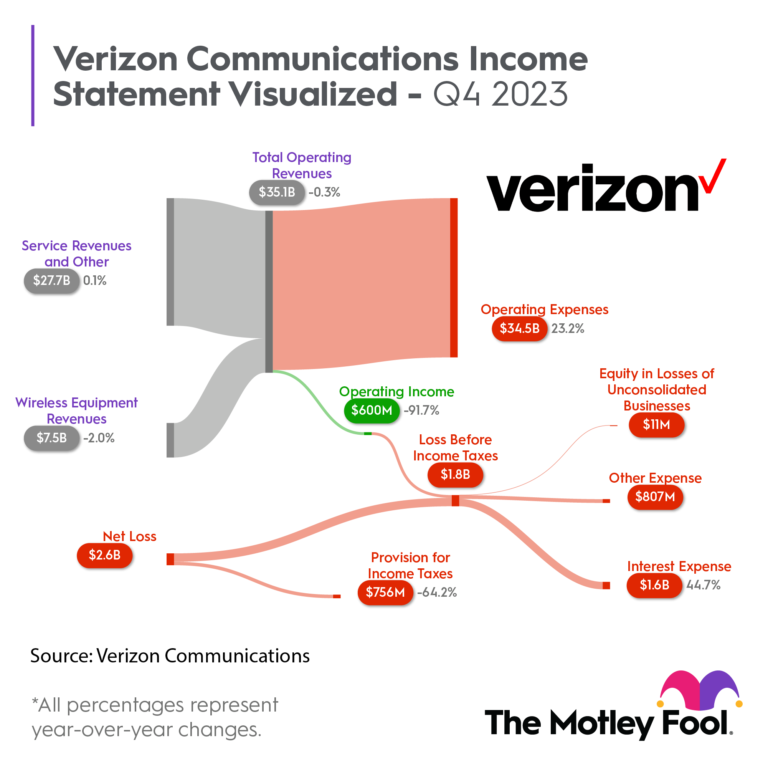

You don't have to struggle to find anything negative about Verizon's fourth quarter results. Looking at the top of the income statement, the telecom giant's operating revenue fell 0.3% year over year to $35.1 billion.

Verizon's sales were primarily due to lower wireless equipment revenue. This was due to a 17.9% year-over-year decline in postpaid upgrades.

Verizon's problems spilled over into its bottom line. The company reported a net loss of $2.6 billion, or $0.64 per share, in the fourth quarter under generally accepted accounting principles (GAAP). In the same quarter of 2022, Verizon achieved his $6.7 billion ($1.56 per share) profit.

A pre-tax loss from special items of approximately $7.8 billion weighed on Verizon's fourth-quarter results. The loss included a $5.8 billion goodwill impairment charge and a $992 million mark-to-market adjustment to the company's pension and other retirement benefit obligations.

However, even on an adjusted basis, Verizon's revenue still fell year-over-year. The company reported fourth-quarter adjusted earnings per share of $1.08, down from $1.19 in the year-ago period.

Signs of hope hailed by investors

Despite the bad news, Verizon stock soared nearly 6% on Tuesday following its fourth quarter update. why? Investors praised some bright spots amid the company's generally gloomy results.

The big story is that Verizon's wireless business has grown tremendously. Net additions to wireless postpaid calls more than doubled from the same period last year to 449,000. Total consumer postpaid phone additions increased 17% year-over-year, marking the company's best quarterly performance since 2020.

Verizon's broadband business also continues to gain momentum. Total broadband net additions in the fourth quarter were 413,000. This marks his fifth consecutive quarter in which Verizon has reported net broadband additions of more than 400,000.

For the full year 2023, Verizon generated $18.7 billion in free cash flow. This total is up from $14.1 billion in 2022.

Investors also like Verizon's 2024 guidance. The company predicts that total revenue for wireless services will increase from 2% to 3.5%, reversing last year's decline.

Is Verizon stock a wise choice to buy now?

Investors looking for strong growth probably won't find Verizon an attractive stock to buy. It's nothing new. But I think the story is very different for income investors.

Verizon's dividend yield is currently close to 6.4%. The company has continued to increase dividends for 17 consecutive years. I expect this shareholder-friendly trend to continue.

Verizon has a healthy dividend payout ratio of 52.8%. Higher free cash flow puts the telecom industry leader in a better position to increase future dividends.

In my opinion, income investors should view Verizon as more than half a glass of water. If you have cash to work with, you might want to take a sip of this solid dividend stock.