STORY: Wall Street's major indexes finished higher on Monday, led by large-cap growth stocks such as Alphabet and Tesla, as investors also look forward to this week's Federal Reserve policy meeting.

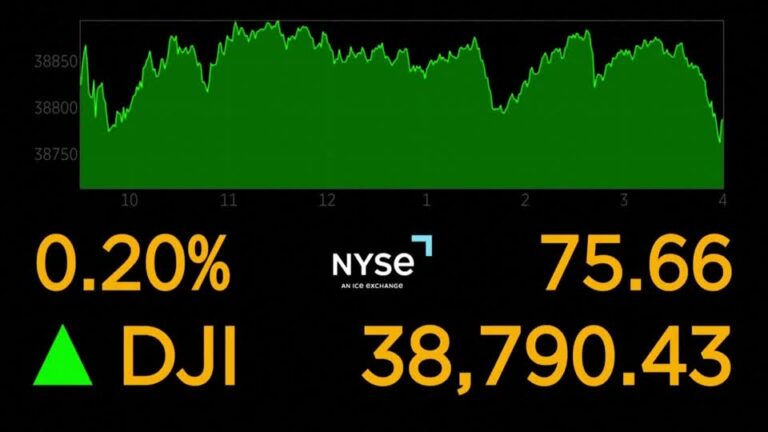

The Dow Jones Industrial Average rose two-tenths of a percent, the S&P 500 rose more than six-tenths and the tech-heavy Nasdaq rose eight-tenths of a percent.

Google's parent company Alphabet rose nearly 4.5% following media reports that Apple is in talks to put Google's Gemini AI engine into iPhones.

Chris Carey, portfolio manager at Carnegie Investment Counsel, said this is a welcome partnership for investors.

“Apple is one of the last big tech companies that hasn't really talked about how they're going to take on the world of AI. They've been very…secretive about the details on this. That's why Google searches… I think it's very encouraging that we've chosen to partner with Google, a company that we have a long-term relationship with, in that they're our default provider. [flash] So I think it's very reassuring for investors to see that Apple is trying to take this issue seriously. ”

In other AI news, Nvidia stock rose more than 0.5 percent, but closed well below its trading high. The world's leading AI chip maker kicked off its annual developer conference on Monday, with CEO Jensen Huang announcing its new flagship AI chip, the Blackwell B200.

Tesla stock ended up more than 6% after the electric car maker announced it would soon increase the price of its Model Y EV in some parts of Europe.

Also, shares of server maker Super Micro Computer, which joined the S&P 500 on Monday, gave up earlier gains and fell nearly 6.5%, the biggest decline of any benchmark index on the day. . However, the company's stock price has increased about 280% since the beginning of the year.

Investors are now looking to the Fed for an update on when it will begin cutting interest rates, with the central bank's March policy meeting wrapping up on Wednesday.