Kumatta/Moment via Getty Images

Dividend investing is a very powerful way to compound your assets over the long term. Not only do high-dividend stocks, especially high-dividend stocks, tend to outperform the market, but dividend investing also has additional benefits.

- force investors to focus Rather than getting caught up in fads that come and go, focus on what matters most: the fundamentals (see the rapid rise and fall of the Ark Innovation ETF (Arkku) and meme stocks like GameStop (GME) and AMC Entertainment (AMC) Examples of this are following the coronavirus disease (COVID-19) outbreak) or an obsession with short-term stock price action. Instead, dividend investors focus on growing their income stream over the long term, which increases their patience and rationality in decision-making.

- It also helps investors keep their wits about them when other investors are losing money. When the market falls sharply, many investors panic, When the market is booming and rising day after day, investors tend to flock recklessly. Dividend investors who buy securities for their squandered income can largely ignore wild market fluctuations and just sit back and let the dividends flow.

That being said, dividend investing is still not easy. In this article, I'll share two important lessons I wish I had known before buying dividend stocks.

#1. Dividends can be reduced without warning

Dividend investors can sleep better at night with stocks like Realty Income (O), Enterprise Products Partners (EPD), Enbridge (ENB), Coca-Cola (KO), and The Home Depot (HD). SWAN”) brand. They raise their dividends every year through strong and weak times, and they don't lose sleep over it even when the market is down.

Indeed, the dividend space is littered with dividend cutters and dividend deleters, especially in high-yield stocks (popular recent examples on Seeking Alpha include Walgreens Boots Alliance (WBA), VF Corp (VFC ), Lumen Technologies (LUMN), but many, if not all, of these stocks had made decisions long in advance, so investors will be shocked by this rate cut, even if disappointed. It couldn't have been.

However, in recent months I've been looking at stocks that are well covered by earnings, backed by investment-grade balance sheets, solid management commitment, a defensive business model, and whose dividends appear to be very stable. Even so, I learned the hard way that the dividends actually appear to be very stable. Not safe from sudden and unexpected disconnections.

Last fall, WP Carey (WPC) abruptly cut its dividend as part of its hasty exit from the office space. As a triple net lease REIT with a BBB+ credit rating, strong performing real estate, good dividend coverage with AFFO, and decades of consecutive dividend increases, the company is one of the last companies I wouldn't have expected to cut its dividend. Met. But it did, betraying many income investors in the process. Granted, the stock has recovered nicely since then, but it still had a very negative impact on the stock in the short term, and dividend investors accepted a pay cut that almost no one expected.

And last week, New York Community Bancorp (NYCB) cut its dividend quite significantly. Although it remains unclear what was behind the move, given key personnel leaving the company and growing concerns about the health of its offices and its portfolio of rent-controlled multifamily mortgages. Management's official statement was that the decision was 100% motivated. This is due to the company's desire to strengthen its balance sheet, given its size of over $100 billion and the increased regulatory scrutiny it faces as a major bank. As a result, stock prices have cratered, with no bottom in sight.

Despite the dividend reduction, the company's dividend is well covered by earnings, its interest rate sensitivity after the Flagstar acquisition is very balanced, and its book value per share has increased following the Flagstar acquisition. The business appeared to be on good footing. It acquired some of Signature Bank's assets for pennies on the dollar, and the company's loan portfolio appeared to hold up very well in the face of growing headwinds in the commercial real estate space. This cut blindsided virtually everyone covering the stock. Dividend investors, even those who try to be a little conservative, can be hit by bad luck due to seemingly random (or at least unpredictable) events.

#2. The market is often smarter than I give it credit for.

While I strongly believe that markets are inefficient, at least in some areas, I've also come to greatly respect Mr. Market's tendency to do far more things right than he does wrong. . There are cases where the market was bullish on stocks, but then a surprisingly bad stock emerges and the stock price plummets, or where a stock that was on the verge of bankruptcy is knocked down but the stock price ends up falling. It may be easy to point out too many things. It will likely recover to pre-crash levels within a few weeks. Indeed, if you look closely, there are many inefficiencies in the market.

But the market's concerns about stocks are often justified, and their bullish views on stocks are usually right. A recent example of Mr. Market humbling me in this way was with NextEra Energy Partners (NEP).

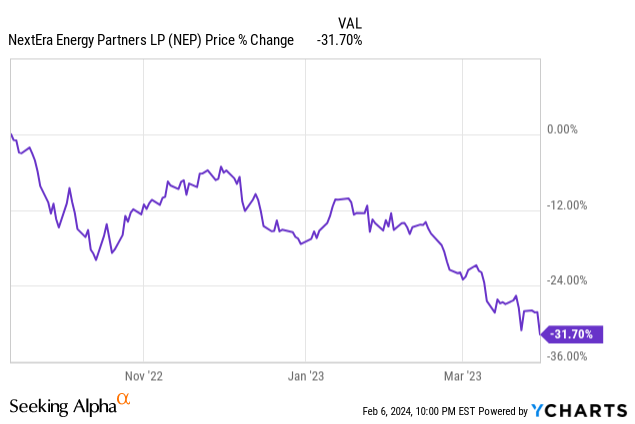

I bought NEP last March for about $60 a share, after the stock had fallen by nearly a third in just six months.

In my view, this company has an excellent track record of growing distributions at double-digit CAGR and delivering attractive total returns to investors, and is well-regarded by A-rated NextEra Energy (NEE). We thought we were a well-supported and defensive company. This business model has a weighted average term to maturity of the power purchase agreement of approximately 13 years and a weighted average credit rating of his counterparty of BBB+. What could go wrong? Sure, higher interest rates would require dividend growth to slow, but yields were high enough that even if we cut dividend growth in half, Even if they have to, total returns are still likely to reach double-digit CAGR. time.

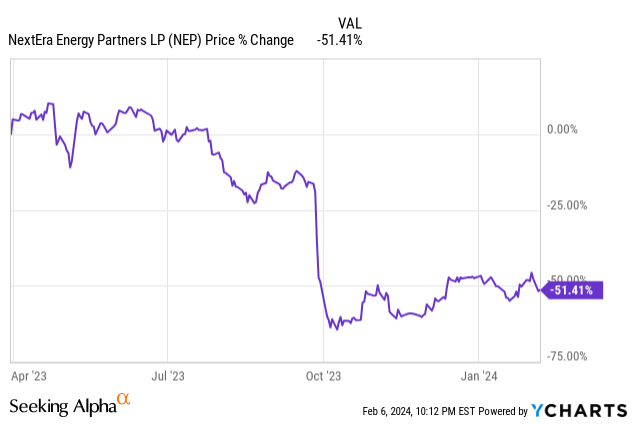

What I haven't been able to fully explain is that so many CEPFs are due within a very limited time frame, and with interest rates rising this much, these can be done without significantly compromising unitholder value. It was a difficult fact to get over. . NEE attempted to rescue itself by suspending its IDRs, and management initiated a pipeline asset sale program in tandem with an aggressive repowering program to continue growing distributions while conserving capital. So far, they are implementing the plan, but the results are uncertain and the pain felt in subsequent unit costs is harsh, to say the least.

The lesson here is that Mr. Market clearly had a reason to discount his shares and did not unreasonably sell about a third of his stock in six months.

Key points for investors

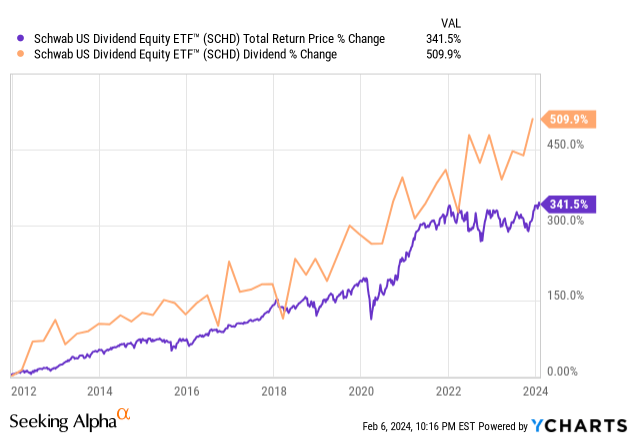

Like many other investors, dividend investing has worked well for my portfolio over the long term. Even a simple investment in a dividend growth ETF like the Schwab U.S. Dividend Stocks ETF (SCHD) can steadily compound wealth over many years while providing rapidly accretive dividends for investors, especially those who reinvest their dividends. It has brought in income.

That being said, I had to learn some important lessons at the school of severe trials. This means that even if you invest in conservative, relatively high-quality stocks with seemingly safe dividends, they can surprise you with sudden gains. Dividend reduction. We also know that while the market often discounts stocks irrationally, there are usually good reasons why stocks are on sale, so not every drop is worth buying. Ta. Deeper due diligence is needed when buying stocks on the spur of the moment if we want to avoid the kind of severe price declines I experienced with NEP last year.