Are you afraid of heights?

With the S&P 500's 26% return last year and strong start to the year, many investors are understandably concerned that this bull market is getting ahead of itself.

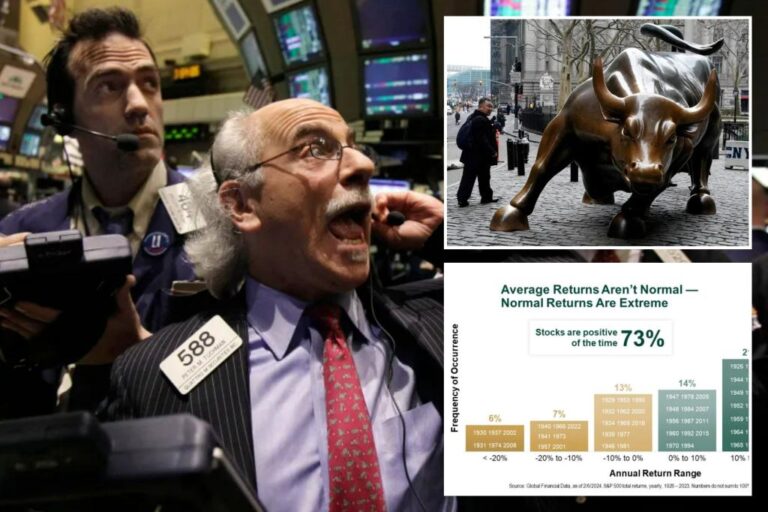

You shouldn't. A strange but true fact is that statistically speaking, the average stock market return (approximately 10% per year over nearly a century of trading) is not normal for the stock market in any given year. The second surprising and happy fact is that so-called “extreme” returns are much closer to what we would call normal, and most of them are in a positive direction.

Most people think of volatility as a negative thing. We all know Peter Tuchman, the New York Stock Exchange's famous haggard-looking floor trader, staring at the Big Board in various states of alarm, but the effect is due to his Einstein-like shock of gray hair. It was emphasized.

The point is that the image, no matter how familiar, compelling, or relatable, is misleading. Volatility is just movement, whether up or down.

If you dig into the numbers, you'll see that stocks rise far more often than they fall. Forget about daily or monthly noises. Since accurate data began in 1925, the S&P 500 has risen 73% of its 12-month cycles, or nearly three-quarters of the time. Expanding to a rolling five-year period, it is 88%. Over 10 years, that's a whopping 94.5%.

On the other hand, over the entire 98-year period, there has never been a 20-year period of negative returns. I never have.

To understand this a little more deeply, consider that since 1925, U.S. stocks have risen more than 20% in 37 of 98 calendar years, which is the most frequent outcome. What is the next most frequent increase? 20% increase from zero, 35 times in total. In 20 years, it decreased between 0% and -20%.

Down bigs were truly rare, occurring only six times. In other words, the market recorded huge gains six times as often as severe declines.

More simply, the stock price has exceeded its long-term average of 10% in 58 calendar years. The frequency of falls of any severity was less than half, at 26. That means, historically, he is more than twice as likely to celebrate an above-average or even great year than he is to experience a down year.

Looking back at the past five years, many people, and rightfully so, fixate on the negative picture of 2022 and call it “unstable.” got it! But what happened to the huge volatility during his 31.5% boom in 2019? Or 28.7% in 2021? And of course, it's 2023. All four years of his life have been extreme.

Even in 2020, it ended up rising 18.4% after a scary start amid a hyper-fast bear market due to coronavirus lockdowns. I hesitate to call anything normal in 2020. But ironically, his 18% return is the closest to average of those years.

Result is? Big returns aren't just a “too far, too fast” rarity as the bears claim. In a bull market, that's rather normal. why? The long-term annual average of about 10% includes bear markets. If we remove the bear markets, we can see that in his 14 S&P 500 bull markets prior to this one, stocks were up 23% annually.

Just to be clear, I'm not necessarily suggesting that returns in 2024 will exceed 20%. But that doesn't shock me, and it shouldn't shock you either. In reality, a return of 20% or more is not at all unusual.

As for your fear of heights, I don't agree with your fear of hot air balloons, mountain climbing, or working as a window cleaner on the Empire State Building, but try to overcome it when it comes to investing.

Ken Fisher is the founder and executive chairman of Fisher Investments, a New York Times bestselling author, and a regular columnist in 21 countries around the world.