More than half of the S&P 500 stocks hit 52-week highs in the first quarter, and we're perplexed as to why this happened. We act as if the Federal Reserve's profits and actions are everything. But maybe it's something else. Perhaps it's the number of shares that trade and the number of shares that don't? That's a strange parallel that is never talked about. So let's talk about it. I would like to start with the housing sector. This group was supposed to disappear through aggressive central bank tightening. This group has 11 cases throughout the cycle. We can look at our group's vulnerabilities and wonder how we can come out unscathed. The balance sheet must be in tatters and the issuance must be a horror show. But what if this group tells you that he has dramatically reduced his share count since 2019? The numbers speak for themselves. Lennar currently has 276 million shares outstanding, down from 318 million five years ago. Toll Brothers had 105 million, down from 145 million. Pulte Group's holdings decreased from 275 shares to 215 million shares. KB Homes' shares decreased from 88 million to 75 million, and DR Horton's outstanding shares decreased from 372 million to 333 million. This change is surprising, but unheralded and largely unnoticed. With 22% of the S&P 500 held by passive index funds, the denominator continues to shrink at an alarming rate. The result is what strategists call long-term change. But that's not the case. The recognition is that these shares are more valuable than the land that could be acquired without the option. Remember, home builders can buy as well as buy land. Most executives at homebuilders other than Toll have not emphasized this fundamental change in stock numbers. I wouldn't have given it much thought if CEO Douglas Yeary hadn't talked about it repeatedly in his amazing clinical call with investors. Anyone who's been around this long enough knows that this group lacked discipline, or at least didn't seem to care about the value of the stock. They were interested in buying land and building a house. We know there is a shortage of homes. These companies won't be expected to do much to alleviate the shortage. Why bother? It's very difficult for them to find land, especially in a place like California, which is pretty fundamentally opposed to development. Housing construction numbers are incredibly low, both recently and historically. Home builders showed remarkable discipline in 2022-2023, building 1.46 million homes, down 9% from 1.5 million the year before. Compare this to the last time the homebuilder went into a tightening cycle in 2005, when he built 2.1 million new homes. At that time there were 295 million people in this country, now there are 334 million. Want to get nostalgic? In 1973, we built 2,289,000 homes for 210 million people in this country. (In 1980 there were 226 million; we built 1.3 million for perspective.) In other words, in the economic downturn of 1973, we went crazy with far fewer Americans. (using census data rather than extrapolating illegal immigration from public opinion polls). In 2005, before the housing bubble burst, we were obsessed with her 2.1 million homes, even as interest rates were about to go up. More frankly, home builders have shown no discipline in the vicious tightening cycle. They learned their lesson. But investors and hedge funds didn't. Anecdotally, this was the group to short. In retrospect, it was Cover, Hold, Buy, as the builders decided to pay little attention to the census figures and instead focused on stock and land purchases, preferentially choosing the former. It was a group to do. strange? Is it unstable? What about Brilliant? Great as are many other companies. We acquired consumer technology retailer Best Buy this week to gain credibility. Why not? Management has been on a buying spree since 2019, reducing the number of shares from 264 million to 215 million. As PC refresh cycles begin and refurbishments and repayments resume, you will see spikes above the band. That's what we saw: Dick's Sporting Goods grew from 87.5 million shares to 80 million shares Abercrombie & Fitch posted a surprising performance, from 64 million shares to 50 million shares Williams-Sonoma has shrunk from 78 million shares to 64 million. Autozone has gone from 25 million to 17 million. (You're probably wondering why I'm paying so much attention.) This is simply a staggering decrease in market share. Even if you exclude auto retailers AutoNation (90 million to 42 million shares outstanding) and CarMax (174 million to 150 million shares outstanding), there's still a lot of discipline. Can be seen. Think of it all like this: Specialty retailers have been bullied and sold short to no end. Bad call. You can challenge the big boxer. Only Walmart reduced that number from 8.6 billion to 8.1 billion. But it's clearly an outlier. Companies that thought their stocks were cheap performed spectacularly during the recovery from the tightening cycle and continued to buy them. The same was true for cyclical stocks. Caterpillar CEO Jim Umpleby has been buying a lot of stock since 2019, shrinking his stock count from 561 million to 504 million. Eaton stock fell from 420 million shares to 401 million. Illinois Toolworks fell from 323 shares to 300 million. DuPont's 1 million shares showed an abnormal decrease from 746 million shares to 430 million shares (affected by organizational restructuring) Dow Company's shares decreased from 742 million shares to 703 million shares Cut Cummins went from 155 million shares to 141 million shares Oh, you want to be greedy? Consider economically sensitive refiners, one of the best-performing groups in the entire market. Marathon Petroleum has decreased its outstanding shares from 810 million to 584 million. (Elliott Management, which almost always goes after companies it believes are undervalued and should buy back their stock, has a lot to do with this.) Valero Energy has increased its holdings from 413 million shares to 337 million. Reduced to stock. Finally, the rails that are constantly attacked by proxy: Union Pacific stock goes from 703 million shares to 608 million shares; Norfolk Southern stock goes from 263 million shares to 226 million shares (currently in proxy contest) (Under siege from activists on the verge of war.) CSX goes from 2.38 billion shares to 1.9 billion. Lest you think this is all a giant anomaly, tech and healthcare companies sometimes Although there are times when the company's performance is poor, it almost always issues sloppily. It's embarrassing how much stock technologists issue, but it's why stock-based compensation is so prevalent. It's no coincidence that five hedge funds have called on Salesforce CEO Marc Benioff to halt stock issuance and begin buying back the company's free float. As of January 31st, there were 984 million shares, down from 997 million shares in the same period last year. Stock prices are moving in the right direction. To be sure, there are tech companies like Nvidia that earn more than their stock price. However, interestingly, CFO Colette Kress has kept the stock count steady at 2.4 billion shares since 2021. Apple continues to buy stocks, reducing the number of shares from 18.6 billion in 2019 to 15.9 billion. Microsoft did the same, going from 7.6 billion shares to 7.43 billion. — a little lighter than people would like. There are not many significant buyers outside of the Meta Platform trading class. 2.88 billion to 2.63 billion. In most other sectors, it is not a requirement. The pattern is unmistakable. Not being aware of it is the same as blaming those qualities on companies that don't deserve them. Earnings may vary. But what about repurchases? There aren't that many. I wish more attention had been paid to this. We had a great win with Caterpillar stock, but the stock continued to rise and was another 60 points from abandonment. The number of shares is more important than profit. What does that mean? American companies believe that if they are going to issue stocks, it would be better to create a full-fledged long-term wave. Otherwise, they'll be left behind in the despised group of malls like ANF, Best Buy, Dick's, and Williams Sonoma. Railroads and refineries will not allow short circuits without substantial consequences. Due to the growth of passive index funds, equity reductions lead to higher stock prices. They are so greedy that we can only guess how difficult it will be for him to reduce the number of shares from 300,000 to 500,000 without moving any shares. You can buy as much technology as you like in that size. As they say in the business world, they trade like water. The same goes for healthcare stocks, where companies need to issue stock to find an external pipeline. My rather forceful conclusion is very simple. Please check the number of shares before you buy them. They want a management team that agrees with them, not one that thinks they can give away stock as compensation to get rid of the smell of fraudulent earnings power. Or, if the home builder lacks funds to complete this cycle, send me an invitation to the funeral. They know what happened in this country. We oppose construction regardless of the price of housing, which has increased by 40% in the past five years. Perhaps they all learned their lesson from 2005. Or maybe he learned the lesson of passive investing and precious land, that you have to be crazy to think homebuilder stock prices have anything to do with his Fed tightening cycle. That would only matter in a different world where the focus is endless on the Fed. If our purpose is to help people make money, what a disservice we have done to the average investor with the Fed's relentless coverage. But if you only care about cash and stock competition, that's a very good thing. And there, with the index and interest rates of 4-5%, the brilliance of small stocks is even more pronounced. I lament the Fed's difficult reporting. When I cover a story on a typical assignment as a reporter, we look at the daily report, which is the standard release of numbers that will be published, including murders, robberies, etc., and nothing else. I wrote the article by heart because I had never done it before. Nothing else was happening. Now, all the rotary speeches of countless Fed officials are taken as gospel. If you're a theorist, that should be gospel. But stay out of my zone. I can't tackle him. This isn't the NFL. His coverage is so strong that he can force the offense to go elsewhere. For now, that's good enough for me, and I hope it's good enough for all club members. (See here for a complete list of Jim Cramer Charitable Trust stocks.) As a subscriber to Jim Cramer's CNBC Investment Club, you will receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in a charitable trust's portfolio. If Jim talks about a stock on his CNBC TV, he will issue a trade alert and then he will wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.

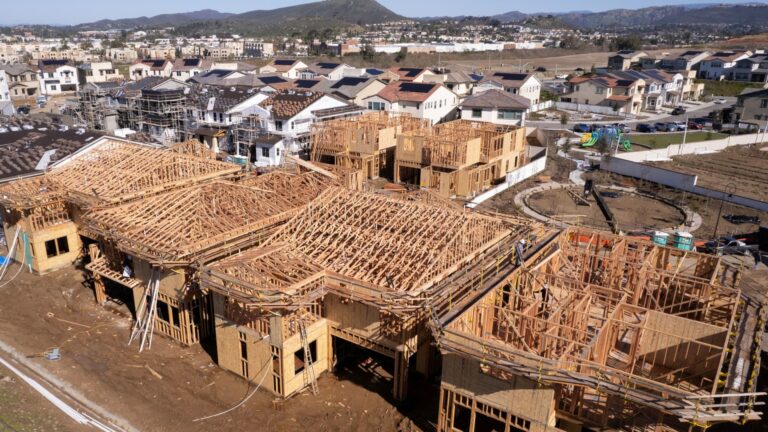

Construction workers work on building homes as a residential subdivision is being built in San Marcos, California, January 31, 2023.

Mike Blake | Reuters

More than half of the S&P 500 stocks set new 52-week highs in the first quarter, leaving us perplexed as to how this happened. We act as if the Federal Reserve's profits and actions are everything. But maybe it's something else. Perhaps it's the number of shares that trade and the number of shares that don't? That's a strange parallel that is never talked about.