This company's technology is something most chipmakers desperately need.

Are you looking to the stock market to become a millionaire? If so, great choice! Stocks are one of the most proven ways to build wealth that beats inflation. The key is discipline, patience and, of course, choosing the right stocks in the first place.

Will technology stocks be viable against this background? ASML Holding NV (ASML 0.72%) Can you turn $20,000 now into a seven-figure sum in your lifetime? Here's what you need to know:

There's a reason why ASML Holding is the best of the best

You may already be benefiting from this technology without even realizing it.

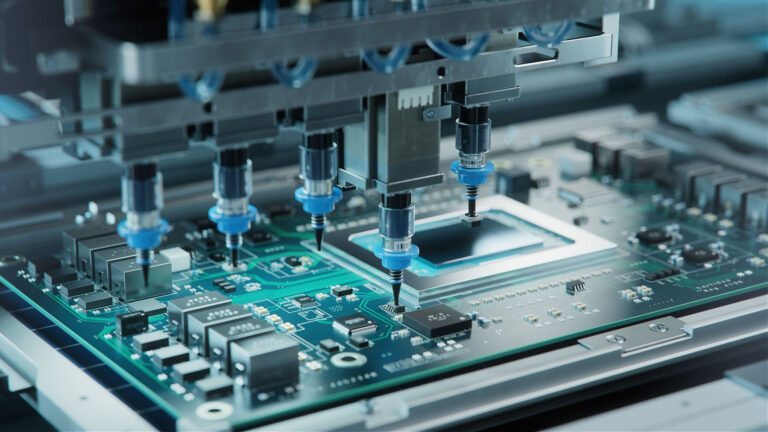

Based in the Netherlands, ASML helps chip manufacturers such as: intel and taiwan semiconductor Making semiconductors using only light. Specifically, the company's technology is used to deposit conductive circuits onto silicon using extreme ultraviolet (or EUV) light shining through a patterned reticle. This process, called lithography, is superior to other approaches precisely because it facilitates the creation of tiny microchips. In fact, the company's latest technology allows it to lay lines just 3 nanometers wide on silicon. (Incidentally, it's about 1,000 times thinner than a human hair; it can only be seen with a powerful microscope.) These chips also require less power to function.

Here's the kicker. As a leader in the global lithography equipment market, ASML is well protected by a military war chest of patents.

This turned out to be a bit of a headache in a few different ways. First, ASML becomes a target for corporate espionage, which ultimately threatens its patent-protected advantage over competitors. And second, given its importance to the world's high-tech manufacturing sector, the company sometimes gets caught in the middle of international and political trade wars.

But don't sweat too much. None of these challenges is something the company hasn't faced or overcome before.

This competitive advantage is enhanced by a never-ending stream of new patents. For example, this year alone, ASML has already patented a new method for generating mask patterns for use in patterning processes and a new method for aligning lithography equipment. These patent-protected leaps are enough to keep the company ahead of its competitors.

More importantly for interested investors, the need for high-performance chips will only continue to grow.

With a tailwind that will never disappear

No matter how you slice it, the future of ASML is bright.

For example, consider lithography itself. According to technology market research firm Mordor Intelligence, the global EUV lithography market is expected to grow at an annual rate of more than 11% until 2029, although this is not as optimistic as the outlook for other EUV lithography markets.

Driving this need for new EUV lithography systems is the growing demand for more technology-driven solutions and the resulting overall need for more computer chips. Although the chip market's already huge size will likely keep growth at a single-digit pace in the coming years, the need for high-performance semiconductors made with ASML's technology is stronger than the overall average would indicate.

Further supporting this demand is the advent of artificial intelligence (AI), which typically requires the highest performance and most efficient chips. In this vein, Mordor Intelligence predicts that the AI hardware market itself will grow at an annual rate of 26% until 2029. Nvidia is now the name behind most AI hardware around the world. Note that most of Nvidia's chips are manufactured by the aforementioned Taiwan Semiconductor, and ASML's largest customer is Taiwan Semiconductor.

Connect the dots. The growth of AI will ultimately drive the growth of ASML.

ASML stock could indeed make you a billionaire

Still, from $20,000 to $1 million? That's quite a feat!

However, never say “never”.

From the beginning, S&P500The average annual return is just around 10%. Some of them have been great years. Others were terrible. But what matters to investors is the long-term average.

Let's conservatively assume that ASML stock can outperform this overall average with an average annual increase of 12%. Let's also assume that ASML reinvests the (very) modest dividends it pays into more shares of the stock itself. How long will it take for ASML stock, currently worth $20,000, to become $1 million? It's about 33 years, whether it's a few months or a delay.

ASML Revenue (Quarterly) Data by YCharts.

It certainly takes a long time. This figure also does not take into account the impact of taxes that may occur at or during the period.

However, this is still no longer than the average career these days, but again, the assumption of a 12% annual return is conservative. In fact, ASML stock has risen more than 20% a year on average since his debut in the late 90s.

But hasn't it been almost 33 years? Or maybe you don't have $20,000 to pick stocks right now?

that's ok. If you own stocks, you need to own multiple stocks, not just one. And you should base your portfolio on choices that are less risky than ASML. After all, the company currently leads the EUV lithography market, but there's no telling what chip-making technologies rivals will develop in the future.

However, don't lose sight of the big picture here. ASML stock consistently outperforms the S&P 500 because it consistently provides the world's best chip manufacturing solutions. That's unlikely to change anytime soon.

James Brumley has no position in any stocks mentioned. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: These are a long call on Intel at $57.50 in January 2023, a long call on Intel at $45 in January 2025, and a short call on Intel at $47 in May 2024. The Motley Fool has a disclosure policy.